Investors doubt AMD’s AI market competitiveness

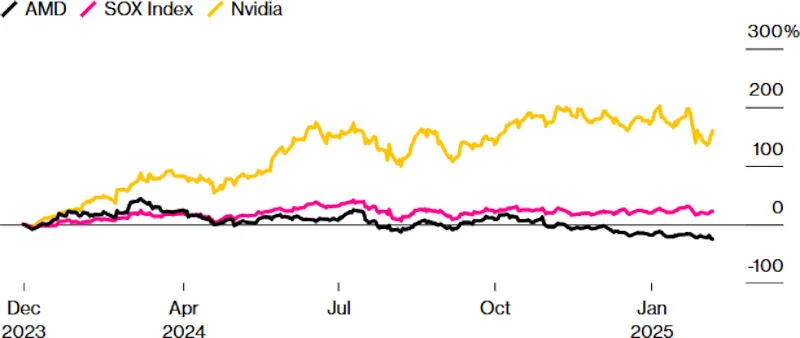

AMD remains Nvidia’s biggest competitor in the AI accelerator market. However, recent stock performance suggests that investors are uncertain about the company’s ability to compete effectively.

Since reaching its peak at the end of 2023, AMD’s stock has dropped by 25 %, hitting its lowest level since November 2023. In comparison, the Philadelphia Semiconductor Index grew by over 20 % in the same period, while Nvidia’s stock soared by 160 %. On February 7, 2025, alone, AMD shares declined by 0.9 %.

The decline is largely attributed to CEO Lisa Su’s cautious stance during the company’s earnings call. She refrained from providing a separate annual forecast for AI accelerators, a key product category for AMD. Investors interpreted this as a lack of a clear growth trajectory for the next six months, making AMD a less attractive investment. The situation was further aggravated by the fact that AMD had previously shared detailed insights into its AI-related revenue. This sudden shift in communication raised concerns that Nvidia had gained an insurmountable lead, putting AMD’s AI chip strategy at risk.

Despite these concerns, AMD’s overall financial results exceeded expectations, and its general outlook remained positive. Lisa Su stated that AI accelerator sales in the first half of 2025 are expected to remain at the same level as in the second half of 2024. However, improvements could come mid-year with the launch of AMD’s next-generation accelerators, which has given some investors hope for steady growth.

Nevertheless, analysts remain cautious. Citi downgraded AMD’s stock, while Bank of America, HSBC Holdings, and Melius Research highlighted the fierce competition with Nvidia. According to IDC, Nvidia held an 89 % share of the global server GPU market in Q3 2024, while AMD had only 10.3 % and Intel just 1.1 %.

Despite current pressures, investors do not see AMD’s position as hopeless. Nvidia and Broadcom are unlikely to meet the entire market demand for AI accelerators, and if AMD can increase its market share to just 15 %, its revenue could see significant growth. Analysts have revised their forecasts: AMD’s revenue is expected to grow by 24 % in 2025, while net profit is projected to more than triple. In 2026, growth is expected to slow, with revenue rising by 21 % and net profit by 46 %. This suggests that AMD’s stock is currently trading at a 35 % discount compared to the average target price set by analysts. As a result, the worst may already be over for AMD in the stock market. Read “Zamin” on Telegram!

Ctrl

Enter

Found a mistake?

Select the phrase and press Ctrl+Enter