Advantages of OSGOP insurance for drivers and carriers

Every day, you transport dozens of passengers—whether by taxi, shuttle buses, or intercity buses—and everything may seem under control. However, traffic accident statistics in Uzbekistan suggest otherwise: in 2024, 9,364 traffic accidents were reported, resulting in 2,203 fatalities and 8,901 injuries. For a carrier driver, any incident could lead not only to mandatory downtime but also to personal liability, fines amounting to tens of millions of som, the suspension of licenses, and the loss of passengers' trust.

Many drivers and companies underestimate the financial risks associated with operating without an OSGOP policy, but a solution exists: Euroasia Insurance's OSGOP insurance provides up to 44 million som of coverage per passenger (covering life, health, and property), an online application process in just five minutes, reliable payouts, and round-the-clock support. This ensures compliance with legislation while protecting businesses, income, and passengers.

Key traffic accident statistics in Uzbekistan

| Year | Reported Accidents | Fatalities | Injuries |

| 2024 | 9,364 | 2,203 | 8,901 |

| January–September 2025 | 5,895 | 1,303 | 4,592 |

In just the first nine months of 2025, 5,895 accidents were reported, a 3.8% decrease compared to the same period last year. Nevertheless, one in ten to twenty carrier drivers will eventually face a situation in which a passenger or their property is affected.

Risks of operating without OSGOP:

- Personal liability for harm caused to passengers' lives and health;

- Fines or the risk of administrative suspension of activities;

- A decline in reputation among customers and partners.

Who must obtain an OSGOP policy

According to the Law of the Republic of Uzbekistan No. O‘RQ-386 dated May 26, 2015 "On Mandatory Civil Liability Insurance of Carriers" and Resolution No. 266 of the Cabinet of Ministers dated September 15, 2015, any passenger carrier conducting commercial transportation—whether a legal entity or an individual entrepreneur—must secure an OSGOP policy before beginning operations.

Article 4. Article 25. Obligation to Insure Carrier’s Liability

The carrier must insure its civil liability for harm that may be caused to the life, health, or property of passengers before starting the provision of transport services.

Carriers insured under Uzbekistan's international agreements are exempt, provided their insurance coverage is no less than that required by OSGOP.

The policy is mandatory for all individuals engaged in commercial passenger transportation within Uzbekistan, including:

- taxis;

- shuttle buses and city/intercity/international buses;

- railway transport;

- water transport (boats and ships);

- aviation (domestic and international flights).

Apply for OSGOP online in five minutes

What the OSGOP policy covers

The mandatory civil liability insurance for carriers includes the following:

- Insurance protection for harm caused to passengers' lives, health, and property by the carrier;

- A specific insurance amount set per passenger;

- A requirement for the carrier to inform the insurer and provide necessary documents following an insurance event.

Consequences of not having OSGOP

If a policy is not obtained, the carrier may face the following:

Article 1461 (Civil Code of Uzbekistan) Failure of the Carrier to Fulfill the Obligation for Mandatory Civil Liability Insurance

- Failure by the carrier to fulfill the legally established mandatory obligation for civil liability insurance for harm caused to the life, health, or property of passengers results in fines for officials ranging from seven to ten times the monthly calculation rate.

Full personal liability for damage caused to passengers.

Coverage under OSGOP insurance

| Coverage Type | Maximum Amount per Passenger |

| For passenger’s life and health | Up to 40 million som |

| For passenger’s property | Up to 4 million som |

| Total insurance amount | Up to 44 million som |

Example of OSGOP calculation

Let’s assume you own a minibus with 15 passenger seats and need to apply for an OSGOP policy for a 12-month period.

With a liability of 44 million som per passenger, the total insured sum will be:

15×44,000,000 = 660,000,000 som.

The base annual rate for minibuses is 0.0606%.

The insurance premium is calculated as follows: 660,000,000×0.0606% = 399,960 som. In case of an insurance event, the maximum payout per passenger is up to 44 million som.

Thus, the OSGOP policy is not mere formal compliance but a tool for risk management and business protection.

Actions to take during an insurance event

In case of an insurance event, the carrier should:

- immediately notify the insurer;

- gather and submit necessary documents (claims from the injured party, payment confirmations);

- wait for the insurer's decision—payment will be made no later than five business days after the approval.

Real-life scenarios for carriers

- Scenario A - a city taxi without a policy: an accident occurs, a passenger is injured, and the carrier (driver) bears all damages personally.

- Scenario B - a shuttle bus with policy coverage: several passengers are injured, the insurer compensates the losses, and the carrier continues operations unaffected.

- Scenario C - an intercity bus: policy coverage does not match the actual passenger count; compensation may be denied.

Most importantly, damage caused to passengers' lives, health, and/or baggage is guaranteed to be compensated within the insurance limit.

Conclusion: The OSGOP policy must correspond to the actual operations, seat capacity, and route of the carrier.

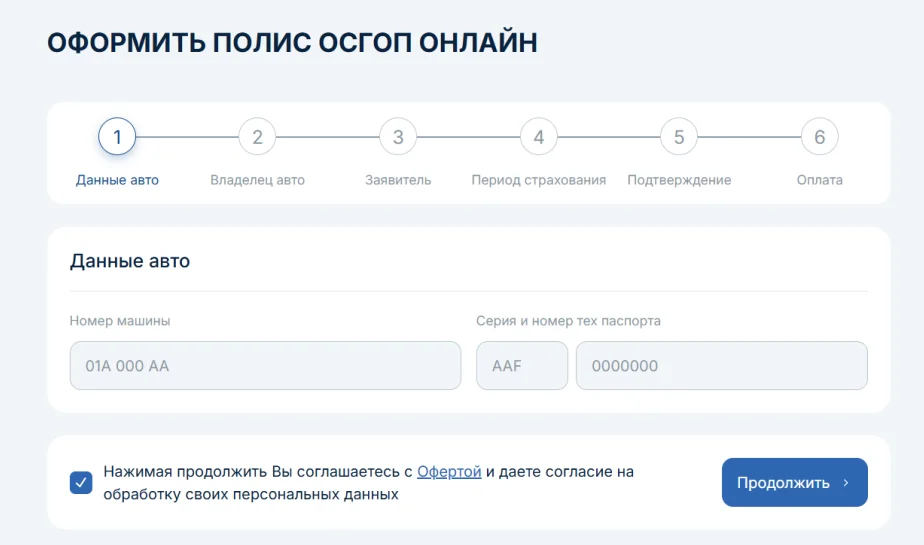

How to apply for OSGOP online - step-by-step guide

1. Enter the vehicle’s license number and technical passport details

2. Provide the owner's information and select the insurance duration (from 3 months to 1 year)

3. Make payment using a convenient method - Click, Payme

4. Immediately receive the electronic policy in pdf format via email or in your personal account after payment

Recommendations for carriers

- Ensure the OSGOP policy matches the transport type and passenger capacity.

- Prepare necessary documents: license, technical passport, and owner or sole proprietor data.

- Apply for the policy in advance and renew it 10–15 days before it expires.

- Keep copies of the policy in both digital and printed form.

- Instruct drivers not to operate vehicles without a valid policy.

- Regularly compare your operations with the terms of the policy.

Conclusion

For taxi drivers and carriers, obtaining an OSGOP policy is a legal requirement that provides robust protection for passengers and carriers while minimizing financial risks. Failure to comply may result in fines, suspension of operations, and full personal liability for damages caused to passengers. For businesses, OSGOP serves as a critical tool for safety, reputation management, and operational continuity. The policy can be quickly and conveniently obtained anytime through the website or the EAI mobile app.

Don't delay in securing the protection of your business and passengers!

Get your OSGOP policy online from Euroasia Insurance within just five minutes and ensure dependable protection of up to 44 million som per passenger.

Phone: 1147.

E-mail: info@eai.uz

Website: eai.uz

Instagram: @eai.uz

Telegram: t.me/ea_ins

Sponsored Content

Read “Zamin” on Telegram!