Uzbekistan's 7.6% Growth: A Serious IMF Warning About "Overheating"!

The mission of the International Monetary Fund (IMF) announced its final conclusions following its visit to Uzbekistan. According to the IMF, the real GDP volume grew by 7.6% in the first nine months of 2025. This growth is mainly attributed to large investments and increased household consumption. The positive aspect is that, despite rising demand, inflation rates slowed down and reached 7.8% by the end of October.

Secrets of External Stability

The factors contributing to the inflation slowdown include the maintenance of a tight monetary policy, the strengthening of the real exchange rate, and the diminishing effect of last year's energy price hikes. The IMF noted that the foreign trade deficit (current account deficit) significantly narrowed due to high gold prices and active export growth. By the end of October, international reserves reached the level of covering 12 months of imports.

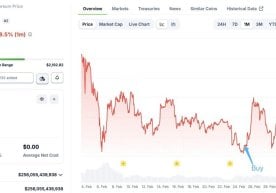

The Risk of the "Gold Fever"

However, the IMF warned of a serious danger. The risk of further inflation acceleration is linked to the practice of excessively spending above-plan budget revenues (especially from gold), as well as the expansion of preferential lending programs. In conditions of high demand, such an increase in expenditures could lead to the economy "overheating".

IMF Recommendation: Financial Discipline

According to international experts, it is extremely important for the state to maximally refrain from increasing expenditures to reduce the risk of economic fluctuations. Limiting initiatives to increase expenditures from unplanned additional revenues will reduce inflationary pressure and prevent the need for sharp changes should gold prices fall. This also creates the possibility of accumulating buffer funds for the budget.

Read “Zamin” on Telegram!