Tesla stock plunges 25% – What’s behind the decline?

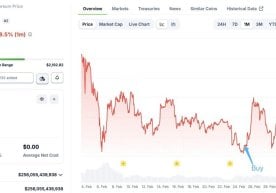

Tesla is facing increasing challenges in maintaining its status as the largest electric vehicle manufacturer. Growing competition in China and Elon Musk’s political activities on the global stage are negatively impacting the company’s business. As a result, Tesla’s stock has dropped 25% from its December peak.

According to Bloomberg, this week has been Tesla’s worst since October, with shares falling by 11%. The company’s January EV sales also contributed to this decline. In Germany, Tesla’s deliveries dropped to their lowest level since 2021, while France and the UK also showed negative trends. In China, Tesla’s largest market, deliveries fell by 11.5% year-over-year and more than 30% compared to the previous month.

Tesla’s stock surge in December was largely due to Elon Musk’s close ties with Donald Trump, who won the US presidential election. However, investors soon realized that the new US president plans to cut EV subsidies, which could hurt Tesla’s business. In Europe, Musk’s political activity has also begun to alienate consumers. As a result, Tesla’s shares have become the worst-performing among major tech companies, including Apple, Microsoft, Nvidia, Alphabet, Amazon, and Meta.

Analysts expect Tesla’s stock to continue declining over the next two to three weeks. For some investors, this could present a buying opportunity. Currently, Tesla shares are trading at around $362, with a resistance level at $350. On average, Bloomberg analysts predict Tesla’s stock will remain around $360 over the next 12 months. Read “Zamin” on Telegram!

Ctrl

Enter

Found a mistake?

Select the phrase and press Ctrl+Enter