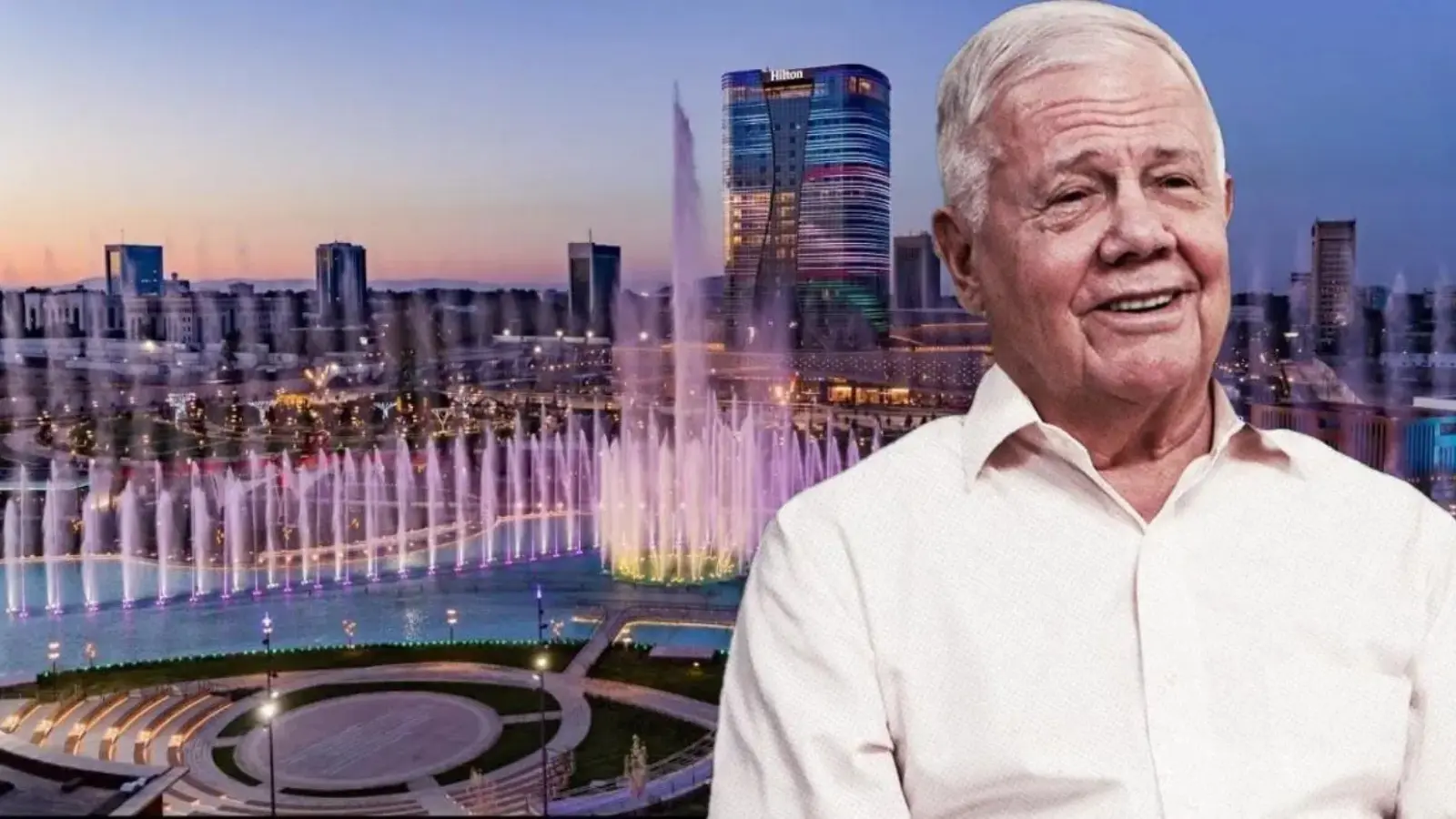

Investor Jim Rogers sold his shares in the USA and chose Uzbekistan

Jim Rogers, a well-known investor who watches financial markets around the world like a "pulse," took an unexpected step: he announced that he had fully sold his US shares and turned his attention to the Uzbek stock market.

According to the investor, the US market has been growing steadily since 2009, becoming one of the longest growth cycles in history. Rogers, feeling that this "long marathon" was coming to an end, decided to close his assets in the USA.

Although he did not specify the exact date, he noted that the agreements were completed by the end of 2025.

The most interesting is the "unusual destination": Uzbekistan

During this period, Rogers added Uzbek stocks to his portfolio. In his words, there are not many shares traded on the local exchange, and he "bought almost all of them."

Currently, shares of 85 issuers (banks, oil and gas, telecom, and other sectors) are traded on the "Tashkent" stock exchange.

There is one nuance here: such statements usually cause "noise" in the market. Because one investor's statement "I bought almost everything" is also a signal of growing external interest in the Uzbek market.

This interest didn't arise yesterday

Jim Rogers expressed interest in the Uzbek stock market as early as 2021 - at that time he said that he would closely monitor the opening of the country's economy, privatization, and IPO plans.

Another important point: Rogers claims that he only owns shares in Uzbek companies and has even reportedly expressed confidence in the Uzbek soum.

China is left, and the dollar is still a "shield"

The investor has not yet sold Chinese shares: it is noted that the portfolio includes securities of airlines such as Air China and China Eastern. However, he said that "excessive growth" could also be observed in the Chinese market and did not rule out the possibility of future sales.

At the same time, Rogers also stated that he holds a large amount of cash in dollars: although the US debt is record-breaking, he emphasized that in the context of global instability, the dollar will still remain a "safe haven" for many.

In conclusion: Rogers's step is not PR for the Uzbek market - it's a big signal. Now the main question is different: how quickly can our market demonstrate the speed and transparency that will "retain" such interest? If done correctly, this could be just the beginning.

Read “Zamin” on Telegram!