Gold Hits Record High as Silver Prices Surge

On Monday, December 22, a historic event occurred in the global financial markets as the price of gold surpassed the $4,400 per ounce threshold for the first time. Reuters reported this development. Experts attribute this rise to anticipated interest rate cuts in the United States and increased interest in safe-haven assets among investors.

In addition to gold, a sharp surge was also observed in the silver market. Its price rose by 3.3 percent in a single day, reaching a historic high of $69.44. According to Reuters calculations, gold prices have risen 67 percent since the beginning of the year, breaking through the $3,000 and subsequently the $4,000 psychological barriers.

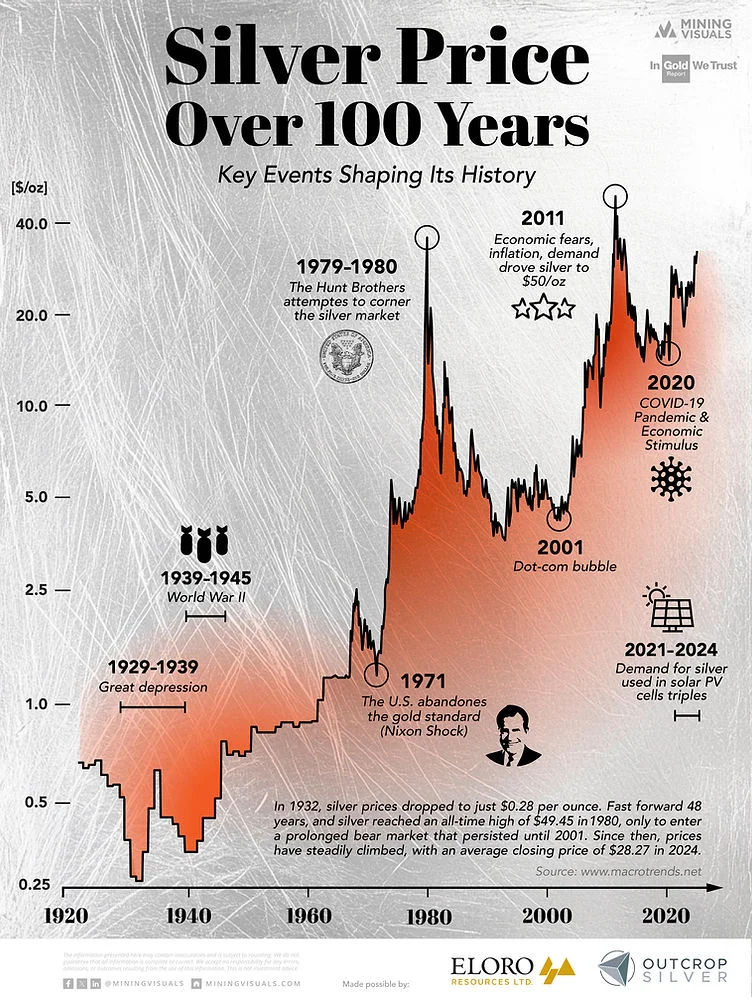

Such dynamics were last observed in 1979, and the current growth could become one of the largest annual increases in recent decades. Silver, however, achieved even more impressive results—its price increased by 138 percent, surpassing gold's growth rate.

Analysts explain this situation with several factors. Firstly, the sharp increase in investment volumes and limited supply in the market are driving prices upward. Additionally, geopolitical tensions, uncertainties in international trade, and active gold reserve purchases by central banks are further boosting the demand for precious metals.

Furthermore, expectations of potential interest rate cuts next year are directing investors towards safe assets such as gold and silver. The weakening of the US dollar has also made precious metals relatively cheaper for foreign investors, stimulating additional demand.

As a result, the gold and silver markets are currently moving at a high pace, and it is expected that this trend may continue in the coming months.

Read “Zamin” on Telegram!