Europe’s demand to remove its gold from the US: geopolitical concerns and independence

A new problematic issue has become the focus of debate in the global financial system: why are billions of dollars’ worth of European states’ gold reserves stored in the United States, and should these reserves be repatriated? Such questions were raised by former European Parliament deputy Fabio De Masi, and Financial Times reported about it in detail.

According to the information, Germany and Italy are the world’s largest holders of gold reserves after the US. Germany has 3,352 tons, and Italy 2,452 tons of gold. A large part of their reserves – that is, bullion worth $245 billion – is currently still stored in America’s Federal Reserve System.

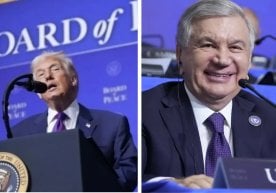

There are several factors behind the appearance of the proposal to return the gold. First, US President Donald Trump’s criticism of the Federal Reserve System and his repeated attacks have heightened the concern of European countries. Second, against the backdrop of global geopolitical instability, German and Italian politicians have started to emphasize the need to ensure full and independent control over their reserves.

According to former Bavarian Christian Social Union deputy Peter Gauweiler, the Bundesbank must not compromise in storing gold reserves and national interests must take precedence. “We need to reconsider whether it has been safe and stable to keep gold abroad over the last decade,” he said.

At the same time, the European Taxpayers Association is also demanding that the finance ministries and central banks of Germany and Italy reconsider their dependence on the Federal Reserve. They emphasize that it is impossible to have full control over gold in the US and that “Trump undermining the independence of the Federal Reserve” is causing serious concern in Europe.

Precious metals expert Peter Boehringer separately emphasized that the idea of returning gold to the homeland is not related to the current US administration, but to the need for full legal and physical control over assets in times of crisis. “Gold is a last resort asset for central banks. Therefore, it is very important to keep it on one’s own territory, without any risk from third parties,” says the expert.

In conclusion, the issue of removing Europe’s gold reserves from the US has now become not only an economic but also a strategic problem. In such a situation, political and legal control over the place where gold is stored is of primary importance for all parties. Read “Zamin” on Telegram!

Ctrl

Enter

Found a mistake?

Select the phrase and press Ctrl+Enter