Every day you transport dozens of passengers in a taxi, route bus, or intercity bus, and it may seem everything is under control. However, traffic accident statistics in Uzbekistan indicate otherwise: in 2024, there were 9,364 road traffic accidents (RTAs) recorded, resulting in 2,203 fatalities and injuries to 8,901 individuals. For a carrier driver, any incident not only means mandatory downtime but also involves personal liability costing tens of millions of soums, fines, suspension of licenses, and loss of passenger trust.

Many drivers and companies underestimate the financial risks associated with the absence of OSGOP insurance policies; however, there is a solution: The OSGOP insurance from Euroasia Insurance provides up to 44 million soums of coverage per passenger (life, health, and property), a quick 5-minute online registration process, reliable payments, and 24/7 support. This ensures compliance with the law while protecting your business, revenue, and passengers.

Key figures for road traffic accidents in Uzbekistan

| Year | Accidents recorded | Fatalities | Injured |

| 2024 | 9,364 | 2,203 | 8,901 |

| January–September 2025 | 5,895 | 1,303 | 4,592 |

In the first nine months of 2025 alone, 5,895 accidents were recorded, which represents a 3.8% decrease compared to the same period of the previous year. Nevertheless, every tenth-twentieth carrier driver sooner or later encounters a situation where a passenger or their property suffers damage.

Risks for carriers without OSGOP:

- Personal liability for harm caused to passengers' life and health;

- Fines or risk of administrative suspension of activity;

- Reputation damage among clients and partners.

Who is required to register an OSGOP policy

According to the Law of the Republic of Uzbekistan No. O‘RQ-386 "On Mandatory Insurance of Carrier’s Civil Liability" dated May 26, 2015, and the Cabinet of Ministers’ Resolution No. 266 dated September 15, 2015, every passenger carrier engaged in commercial transportation—whether a legal entity or an individual entrepreneur—must obtain an FJMSH policy before commencing operations.

Article 4. Article 25. Obligation for carriers regarding liability insurance

A carrier must insure its civil liability for potential harm to passengers’ life, health, or property before starting passenger transportation services.

Exceptions apply to carriers covered under Uzbekistan's international agreements, provided their insurance amount is not less than the FJMSH requirements.

The policy is mandatory for all individuals involved in commercial passenger transportation on the territory of Uzbekistan:

- Taxis;

- Route buses and buses (urban, intercity, and international);

- Rail transport;

- Water transport (boats, ships);

- Aviation (domestic and international flights).

Register an OSGOP policy online within 5 minutes

What does the OSGOP policy include

The mandatory insurance policy for carriers’ civil liability provides:

- Insurance protection for passengers covering harm to life, health, and property caused by carriers;

- A predetermined insurance amount per passenger;

- The obligation for carriers to notify the insurer and submit required documents in the event of an insured accident.

Consequences of not having an OSGOP policy

If no policy is issued, carriers may face:

Article 1461. (Uzbekistan Civil Code) Non-compliance with the requirement for mandatory civil liability insurance by carriers.

- Failure to comply with the law-mandated obligation for civil liability insurance for harm to passengers’ life, health, and/or property will result in fines for officials ranging from seven to ten times the base calculation amount.

Full personal liability for damages caused to passengers.

OSGOP insurance coverage

| Type of Coverage | Maximum amount per passenger |

| Passenger's life and health | Up to 40 million soums |

| Passenger's property | Up to 4 million soums |

| Total insurance amount | Up to 44 million soums |

Example OSGOP calculation

Let’s assume you own a 15-seat route minibus and need to register a 12-month JGAZ policy.

Responsibility per passenger amounts to 44,000,000 soums. Thus, the total insurance amount is:

15×44,000,000 = 660,000,000 soums.

The annual base rate for minibuses - 0.0606%.

The insurance premium is calculated as: 660,000,000×0.0606% = 399,960 soums. In the event of an insured accident, the maximum payment per passenger is up to 44 million soums.

Thus, the OSGOP policy is not just formality but a tool for risk management and business protection.

Actions to take for an insured event

In the event of an insured incident, a carrier must:

- Notify the insurer immediately;

- Collect and submit the necessary documents (victim's claim, payment confirmations);

- Await the insurer's decision—payments are made no later than 5 business days after the decision is issued.

Real scenarios for carriers

- Scenario A - City taxi without a policy: RTA occurs, a passenger is injured, and the carrier (driver) bears full responsibility for all damages.

- Scenario B - Minibus with a policy: Several passengers are injured, the insurer compensates damages, and the carrier continues operations without losses.

- Scenario C - Intercity bus: Policy is issued for fewer seats than actual passengers, leading to potential denial of claims.

Crucially, damages to passengers’ life, health, and/or luggage will be compensated within the insured amount limits.

Conclusion: The OSGOP policy should correspond to the carrier's actual activity, number of seats, and route.

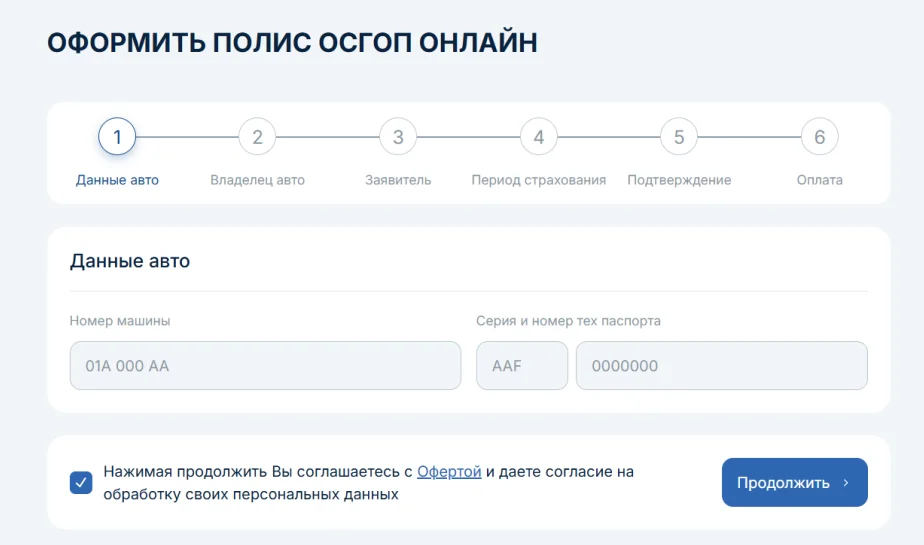

How to issue an OSGOP policy online - step-by-step

1. Enter license plate and technical passport series/number

2. Provide owner details and insurance period (from 3 months to 1 year)

3. Pay conveniently via Click or Payme

4. Immediately receive the e-policy in PDF format via email and personal account after payment

Recommendations for carriers

- Ensure the OSGOP policy corresponds to the specific vehicle and seating capacity.

- Prepare documents for registration: license, technical passport, and owner or individual entrepreneur details.

- Register the policy in advance and renew it 10-15 days before expiration.

- Keep policy copies in both electronic and paper formats.

- Instruct drivers not to operate without a valid policy.

- Regularly compare actual operations with policy requirements.

Conclusion

Registering an OSGOP policy is a mandatory legal requirement for taxi drivers and carriers, ensuring significant protection for passengers and the carrier while minimizing financial risks. The lack of a policy may result in fines, suspension of activities, and full personal liability for damages caused to passengers. For carriers, OSGOP serves as a tool for safety, reputation management, and uninterrupted operations, and it can be quickly and conveniently issued anytime on the website or via the EAI mobile application.

Don’t delay in protecting your business and passengers!

Obtain an OSGOP policy from Euroasia Insurance in just 5 minutes online and gain reliable protection of up to 44 million soums per passenger.

Phone: 1147.

Email: info@eai.uz

Website: Instagram: @eai.uz

Telegram: t.me/ea_ins

Sponsored content

Read “Zamin” on Telegram!