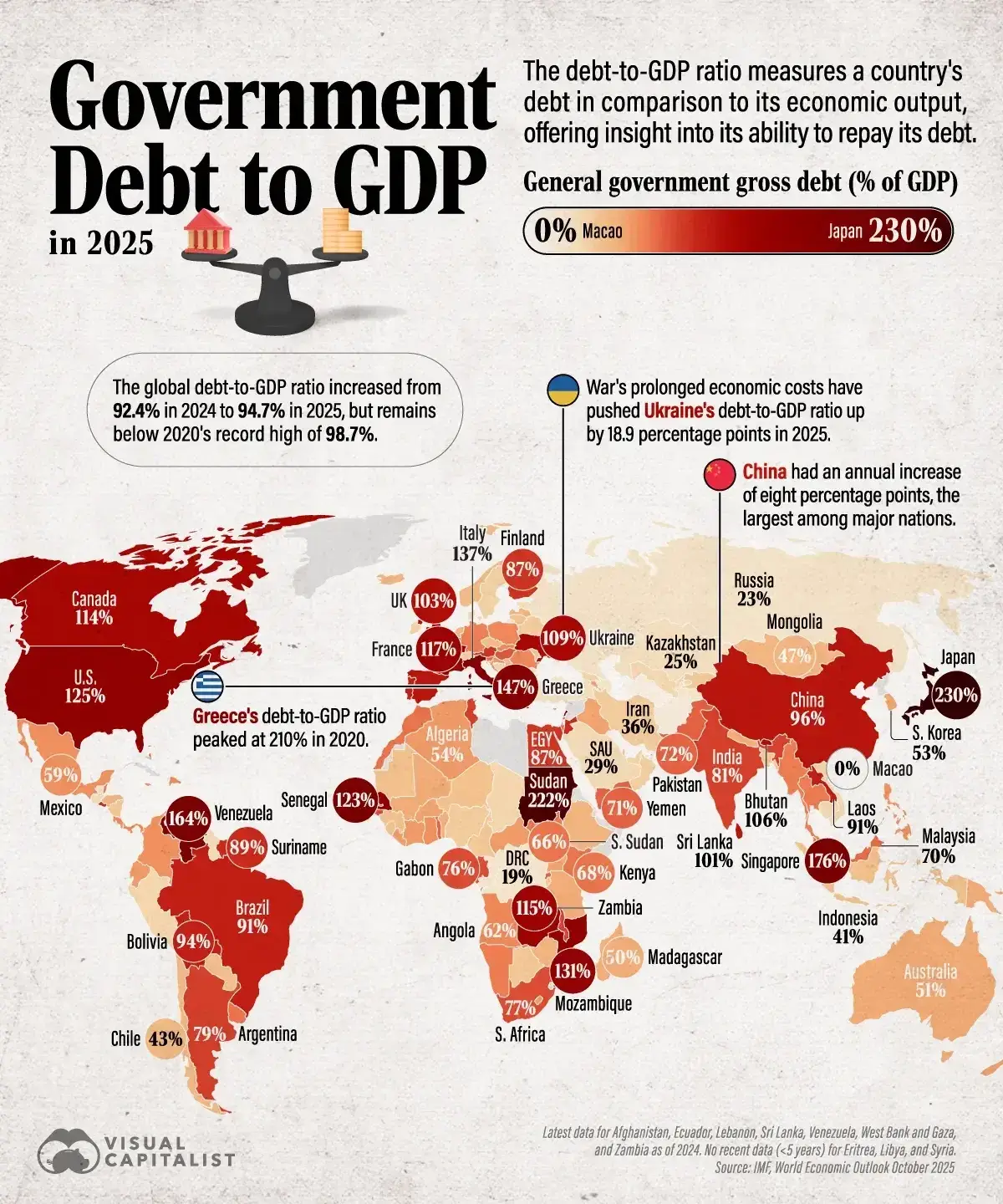

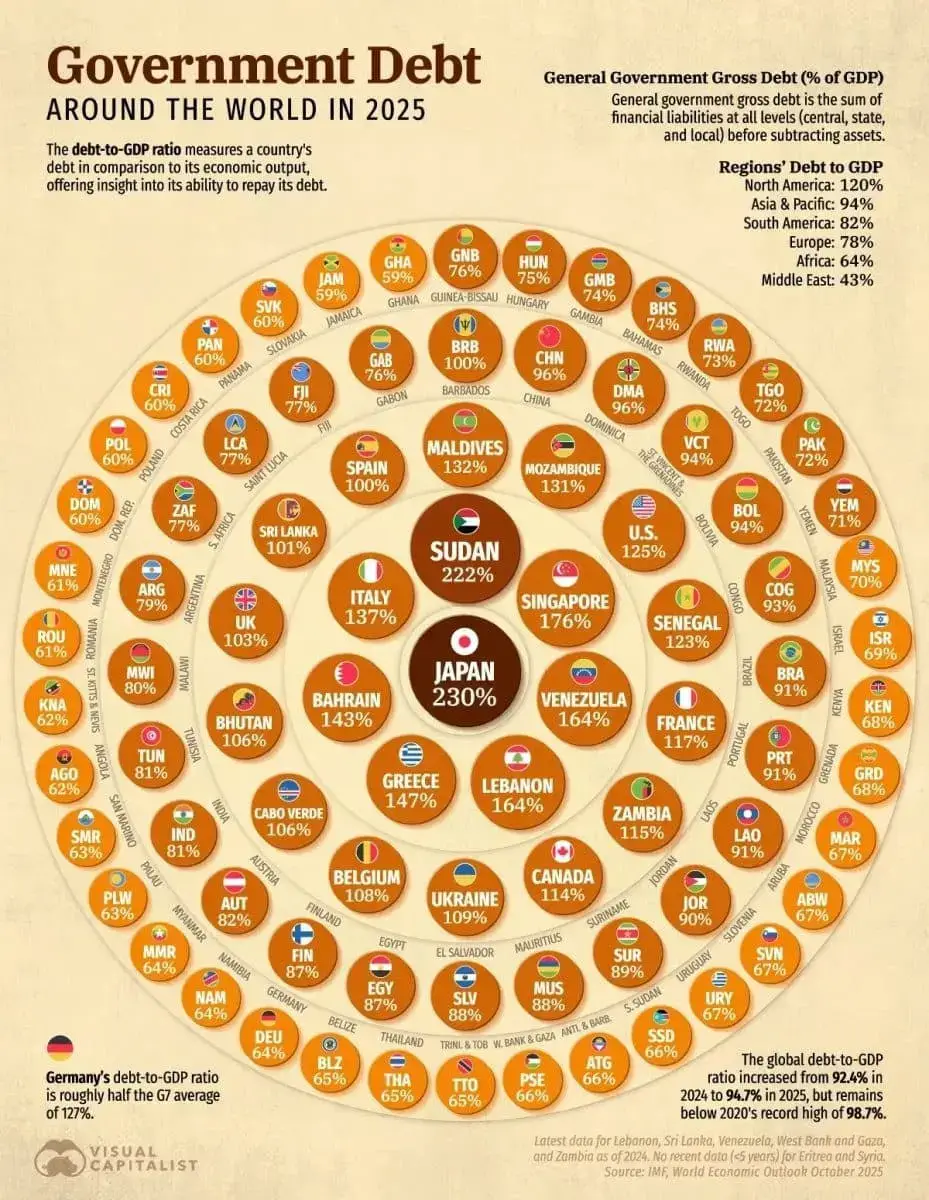

Global National Debts in 2025 Reach New Levels

Updated data for 2025 highlights a significant trend in the global economy: many countries continue to operate with debt levels far exceeding their economic capacity. The ratio of public debt to Gross Domestic Product (GDP) serves as a clear indicator of a country's economic stability or vulnerability.

Experts emphasize that this metric is critical for evaluating a nation's budgetary policy, its degree of external financial dependence, and the efficiency of its economic model.

Countries with the highest debt levels

In 2025, some countries were recorded to have public debt levels double or even more than their GDP:

- Japan — 230%

- Sudan — 222%

- Singapore — 176%

- Venezuela — 164%

- Lebanon — 164%

- Italy — 137%

- United States — 125%

- France — 117%

This list includes both developed countries and those facing economic crises. Notably, while Japan has maintained a high-debt policy for years, in Venezuela and Lebanon, such levels are closely tied to economic instability.

What is the situation in Uzbekistan?

By comparison, it can be noted that Uzbekistan's public debt ratio to GDP stands at just 33%. This figure is considered a safe level by international standards and reflects the country's cautious financial management.

Significant regional differences

An analysis by region also reveals major disparities. The highest average public debt level is observed in North America at approximately 120%. Meanwhile, the lowest average is recorded in the Middle East, with public debt around 43%.

These figures clearly illustrate the diversity in countries' economic models, budgetary discipline, dependence on oil and resources, and social expenditure policies.

Conclusion

The landscape of 2025 demonstrates that public debt is becoming an increasingly critical issue worldwide. While some countries use debt to support economic growth, for others, it poses a serious risk. Uzbekistan, for now, maintains a relatively stable position in this regard—though the real test may lie ahead.