An accountant who asked for $35,000 for 17 billion in VAT "assistance" was detained

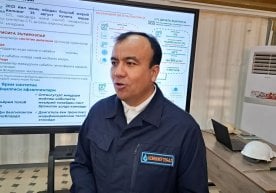

An accountant of a private enterprise providing transport and logistics services operating in the city of Tashkent was detained for demanding a large bribe. According to reports, he promised to "solve the issue" through his former colleagues working in government agencies and asked the dye manufacturer for a large sum of money.

According to investigative bodies, this person demanded a total of $35,000 from the company's founder. In return, he promised to return the negative difference in value-added tax (VAT) in the amount of 17 billion soums and reactivate the temporarily suspended VAT certificate.

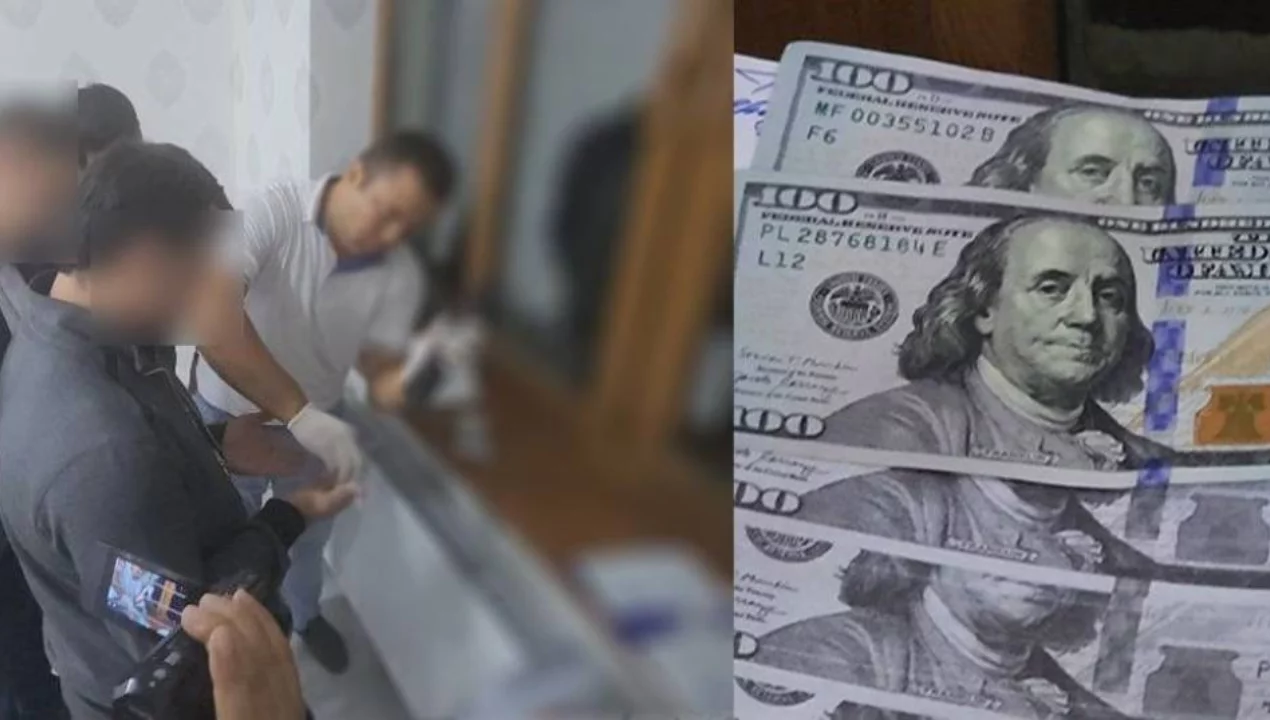

However, the "helpman's" plan did not materialize. During a joint operation by the State Security Service and the Department for Combating Economic Crimes, he was caught red-handed while receiving $20,500.

During the inspections, the accountant reported that he planned to act through a Senior Inspector of the Tax Committee to provide "impartial assistance." Therefore, this civil servant was also brought under investigation and involved in the criminal case as a suspect.

Currently, a criminal case has been initiated under Article 168, Part 4, Clause "a" (fraud on a large scale) and Article 28, Part 3, Clause "a" (attempted collusion in bribery) of the Criminal Code of Uzbekistan.

Investigative bodies have decided to detain some of the perpetrators as a preventive measure.

Law enforcement agencies assess this situation as a vivid example of illegal actions and corruption in the sphere of entrepreneurship.

Representatives of the special service and the department urge entrepreneurs not to believe such "help" offers and to immediately report such cases to law enforcement agencies in order to prevent such situations in society.

This event once again leads to the conclusion that attempting to circumvent the system for financial gain is not only a violation of the law, but also a breach of trust in government bodies.

Read “Zamin” on Telegram!